The global aerospace industry is staring down an existential question with no easy answers: how can one of the world’s most carbon-intensive industries adapt to an era of heightened environmental consciousness?

“Globally, aviation produced 2.4% of total carbon dioxide (CO2) emissions in 2018. While this may seem like a relatively small amount, consider that if aviation was a country, it would rank 6th in the world between Japan and Germany in terms of total CO2 emissions,” said Dr. Alex Ivanenko, founder and CEO of HyPoint.

In a vacuum, those numbers paint a dire picture of an industry with significant problems to solve but limited tools to do so. The full scope of the problem, however, is yet more grim.

“Non-CO2 effects, such as warming induced by aircraft contrails and other pollutants, bring aviation’s combined total contribution to global warming to approximately 5%,” said Ivanenko. “Because decarbonizing aviation will take longer than other industries — new planes sold today will likely still be in operation in 2050 — that 5% of global emissions attributed to aviation is expected to grow to roughly 25% by 2050.”

As the environmental toll wrought by this vital but emissions-heavy industry is increasingly publicly visible, aviation can no longer comfort itself that only “flight shaming” activists are voicing concern. Studies paint a clear picture that Generation Z — who along with millennials will soon form an irreplaceable chunk of the industry’s consumer base —— is highly engaged with the environmental impacts of travel and will adjust transportation choices accordingly.

Nor are governments across the world sitting idly by. In one prominent example, the European Union announced its “Fit for 55” package of regulatory proposals in July 2021 which will look to raise its climate ambitions to a 55% reduction in net greenhouse gas emissions by 2030.

The problem is not that the aerospace decision-makers don’t care about emissions. Cynics may argue that their awareness of the crisis is outweighed by their need to produce healthy revenue reports, but there’s no doubt that the industry has been proactive in looking for solutions.

What gives the task its Sisyphean flavor is the technological constraints binding the industry to its emissions paradigm. Quite simply, it is currently impossible to maintain aviation’s critical role in the global economy without polluting the skies — and no amount of well-meaning but functionally questionable carbon offset programs will change that.

There is growing optimism in some corners of the industry, however, that hydrogen may provide a potential answer. The lightest and most abundant element in the universe offers nearly three times the specific energy of gasoline (120 MJ/kg vs. 44 MJ/kg). It can also be produced as a clean fuel through renewable resources such as solar and wind, though this “green hydrogen” currently only constitutes an infinitesimal fraction of worldwide output.

According to Robin Riedel, a partner with McKinsey & Company who specializes in transformative aerospace technologies and practices, hydrogen is a powerful fuel source that “fundamentally has a lot of things going for it.”

“The energy density versus weight is excellent,” he said. “As a result, you can store a lot of energy for very little weight, which is incredibly valuable in an industry where you’re constantly fighting gravity. It’s also versatile from an engineering perspective — it can be used for hydrogen combustion, traditional combustion, or to generate electricity. The challenge is that as a gas, you need a lot of volume to store it and you need to compress it which causes additional headaches, cost and energy needs. It is also hard to contain — tanking systems are getting better but historically that has been a challenge. And without the infrastructure available to liquid fuels, both fossil and sustainable, you have to build pathways to get the hydrogen manufactured, produced and into the tank.”

From storage logistics to production capacity, paths to certification to economic feasibility in a relatively low-margin business, many questions remain to be answered if the hydrogen revolution is to arrive in the skies. But the aviation industry’s excitement — and more crucially, its investment — portends hope for a promising future.

The Once and Future King?

The element is no stranger to humanity’s journey into the skies, having been used in the hydrogen-oxygen fuel cells — devices that produce electricity directly from a chemical reaction — that powered the Apollo 11 mission. “Without you, we would not have gone to the moon,” President Richard Nixon told Francis Thomas Bacon, the British inventor of the hydrogen-oxygen fuel cell.

Hydrogen’s utility has never been in doubt. But expensive issues with storage — its low ambient temperature density results in a low energy per unit volume, requiring constant compression in gas form or costly and complex conversion and storage in liquid form through cooling at -253°C — and challenges with transportation of the metal-embrittling substance have made it less desirable than far simpler petroleum-based fuels.

“Hydrogen is a much better choice than jet fuel on its fundamental properties alone,” said Ivanenko. “It just hasn’t been as easy to harness hydrogen as it has been to drill for oil. And the problem has always been making hydrogen systems small enough, light enough, and affordable enough for widespread aviation use.”

Jim Lockheed, investment principal at JetBlue Technology Ventures, which aims to position JetBlue Airways for the future with start-up led innovation, is intrigued by the increasing number of possible pathways to overcoming these historical technological and financial obstacles.

“For more than 100 years scientists have been theorizing about hydrogen’s potential in transportation but its technical viability has continued to be challenging,” he said. “It’s been sort of like nuclear fusion, a world changing technology that’s perpetually a few decades away because of serious engineering problems that are yet to be solved.”

His firm’s recent investment in Universal Hydrogen is an indication that those problems are receiving serious attention — and the serious capital required to solve them.

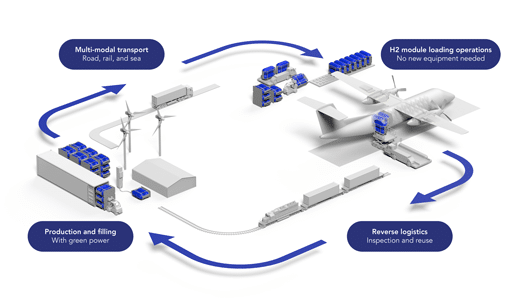

Universal Hydrogen is building a transport and logistics network that moves hydrogen from production facilities to airports in specialized capsules that can also act as modular fuel tanks, able to be directly loaded onto aircraft. The company, which is also developing a conversion kit to retrofit existing regional airplanes with its internally developed hydrogen-electric powertrain, plans to utilize existing global freight infrastructure to ship the capsules.

“We aren’t necessarily investing in this with the mind that the airline will be able to use the technology very soon,” said Lockheed. “Universal Hydrogen will likely start with smaller aircraft, such as turboprops, that JetBlue doesn’t currently have in its network. However, we’re hopeful that in supporting the development of their supply chain and propulsion technologies, it will accelerate the timeline for reaching larger aircraft and network scales. The investment also supports JetBlue’s open commitments to sustainability and we think this is one of the most promising efforts for helping the airline industry decarbonize.”

Rubber, Meet Road

In 2020, hydrogen’s theorized use in aviation transitioned into increasingly credible pathways.

Airbus made waves in September of that year when it announced its ZEROe program, highlighted by three concepts for hydrogen-powered zero-emission aircraft: turbofan and turboprop designs powered by hydrogen combustion in modified gas-turbine engines, and a striking “blended-wing body” design that offers new solutions for hydrogen storage.

Later that year, start-up ZeroAvia’s zero-emission hydrogen-electric powertrain was named one of Time Magazine’s best inventions of the year after a milestone test flight on a Piper M-Class six-seater — a sign that hydrogen’s potential is beginning to receive attention outside of aviation circles.

It is heady times for hydrogen proponents. Heavy hitters in the industry such as Safran, Rolls-Royce and Honeywell have invested in hydrogen fuel cell R&D, and a plethora of start-ups promise grand visions for a clean future driven by hydrogen-based aircraft technology.

Concepts for hydrogen-powered aircraft vary across firms, as the element’s versatility provides numerous options for how engineers wish to deploy it.

“Hydrogen can serve in three different ways in aviation propulsion, the first being as a fuel itself that is combusted,” said Riedel. Though water is the primary emission of hydrogen combustion, it should be noted that this method can still produce non-carbon air emissions such as nitrogen oxide (NOx).

“The second option is using it in a hydrogen fuel cell to create electricity,” said Riedel. “That allows you to use distributed electric propulsion, and again water vapor is your primary emission. The third way it is used is in a power-to-liquid (PtL) process where we take it and combine it with carbon, for example, for direct carbon capture, or alternatively from industry gases that creates a liquid sustainable fuel through the PtL process.”

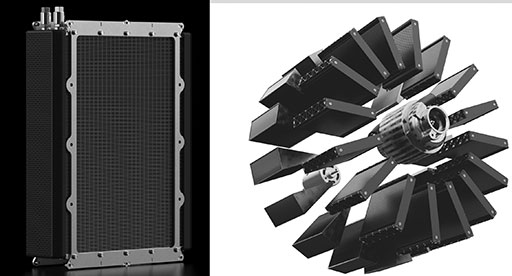

Palo Alto-based HyPoint is on the frontlines of the investment frenzy fueling this wide range of engineering solutions. The company’s NASA-awarded air-cooled hydrogen fuel cell system, which uses compressed air for both cooling and oxygen supply in a design that promises to reduce weight by more than 60%, has been tapped by companies such as ZeroAvia to power their designs.

In a collision of today’s buzziest aerospace technologies, HyPoint reached a $6.5 million deal with Piasecki Aircraft to build a hydrogen system that can be integrated into electric vertical take-off and landing (eVTOL) aircraft, as well as in the first projected manned hydrogen helicopters.

“From a technology perspective, HyPoint is already there,” said Ivanenko, claiming that the company’s turbo air-cooled hydrogen fuel cell system boasts three times the specific power of traditional fuel cell systems and up to 1,500 watt-hours per kilogram of energy density, which will enable longer-distance journeys. “We expect to be able to deliver certified hydrogen fuel cell systems to aviation customers before 2025.”

There are also inroads being made on the infrastructure side of the equation that proponents say will dismantle previous obstacles to hydrogen’s commercial viability.

“The primary impediment to the widespread adoption of hydrogen to date has been an affordable, scalable distribution infrastructure for the fuel, as opposed to the multi-billion dollar incumbent oil and gas investments in pipelines, on-airport storage, in-tarmac pipelines, and tanker trucks,” said Rod Williams, chief commercial officer of Universal Hydrogen.

“Replicating the pipelines and tanker trucks of the oil and gas industry, which are unsuitable for distributing hydrogen, would take trillions of dollars of capital along with decades of work. Today there are already existing logistics networks such as maritime cargo lanes, road and rail networks, intermodal freight networks, and standard containers that are highly efficient systems and ready today.”

It’s Not Easy Being Green

For all of hydrogen’s promise and ongoing development, one substantial question sticks out: how clean is it really? The answer is complicated.

About 99% of the hydrogen produced for industrial use today is “gray” hydrogen derived from natural gas, a process with a 9:1 ratio of CO2 produced per H2. More environmentally friendly “blue” hydrogen captures that CO2 and disposes of it or uses it in environmentally productive ways but can actually result in a carbon footprint worse than fossil fuels due to the energy intensive nature of the process.

Green hydrogen, the foundation on which a cleaner aviation future is premised, is produced through electrolysis, the separating of water into hydrogen and oxygen through electricity – a process that at about $6/KG currently costs nearly two to three times as much as blue hydrogen.

The crux of the problem quickly emerges. For aviation to reduce its carbon footprint through hydrogen, it must use green hydrogen; for green hydrogen to work within airline budgets, it must be cheaper.

“We need a lot of energy to create all hydrogen but especially to create green hydrogen,” said Riedel. “The ratio of the energy that comes out of that process — the fuel that actually propels the aircraft forward versus how much energy it takes to get to that fuel — is not all that good for hydrogen today because it’s just a very energy intensive process.”

If we had unlimited energy from green sources, like solar or wind, that wouldn’t be a problem, said Riedel. But without a fully green electricity grid, hard questions must be asked.

“Should we use the green electricity we can create to produce green hydrogen or is it used better in different places? These are some of the complexities on the topic of hydrogen that we’re tracking.”

Lockheed suspects that the costs involved with producing green hydrogen will result in geographic focus areas if and when hydrogen is to emerge as a viable industry tool for decarbonization.

“We’re going to have green hydrogen production in areas that have the cheapest renewable electricity first, because it’s only going to make sense in areas with very inexpensive renewable electricity programs,” he said. “This could potentially be some of the West Coast, Pacific Northwest, Scandinavia, New Zealand, Australia. From there, what you’re going to see is technology testing, optimization and then it will expand as low-price green energy expands itself and more projects coming online.”

Financial feasibility is king in all industries, but Universal Hydrogen’s Williams is not discouraged by the current price points for green hydrogen. His company is focusing solely on net-zero green hydrogen and has bet that the industry will play ball, especially as renewable energy production ramps up across the globe.

“The steeply declining price of renewable electricity further reinforces our belief that airlines do not need to sacrifice profitability in order to decarbonize their fleet,” said Williams, noting that their partners in the historically low-margin regional airline industry have not been deterred by these questions. “We’ve heard from airlines that they understand regional to be a perfect starting point for hydrogen, and they want to pave the way and be at the forefront of global change.”

Make the Best of What’s Around

The most compelling argument for hydrogen’s emergence is that in a technological landscape bereft of silver bullets, it may offer the best chance at leading aviation to its net zero ambitions.

Hydrogen is far from the only contender in the race to decarbonize aviation. Sustainable Aviation Fuel (SAF), battery-powered electric flight, and various novel propulsion concepts all have their proponents throughout the industry. All also come with enough drawbacks to open the door for hydrogen’s potential emergence.

“If the hydrogen economy is running completely on green hydrogen based on solar, wind, hydro – with better transportation and containment, and powertrains that can use it – I ultimately think in the long run that’s a better option unless newer technologies come onto the scene that can make SAF less resource-intensive or expensive,” said Lockheed.

SAF, an umbrella term for biofuels produced from sustainable feedstocks, has been the most recent belle of aviation’s environmental ball. Already in use throughout the world, its advantages are clear: a drop-in solution deployed today in up to 50% blending, which requires no modification and can leverage existing infrastructure.

“It’s one of the better options out there for helping decarbonize aviation; however, there are issues with SAF,” said Lockheed. “Production is being ramped up and at some point, it will become a lot cheaper and more available but as of right now, it is still significantly more expensive than jet fuel.”

It is also resource-intensive in ways that may pose supply chain challenges as production scales up and potentially competes with food sources for land mass or agriculture, though similar criticisms can apply to the consumption of resources required for hydrogen production.

Lithium-ion batteries can be seen on roads across the world powering automobiles like Tesla, but their use in aviation still faces serious technological hurdles. Despite their increased efficiency in energy applied to propulsion, there is a sizable gap in energy density between batteries and hydrogen or other liquid hydro-carbons — a gap that remains prohibitive to powering larger aircraft, despite advances in battery density technology.

Another problem is that the weight of batteries is constant throughout the entire flight, unlike fuels which diminish as they are used. Operators ultimately pay an efficiency penalty for carrying that weight for the full duration of the journey.

“If you look at a big airplane today, an Airbus 320 or Boeing 737 will burn about 2.5 tons of jet fuel every hour,” said Riedel. “If you have a four hour flight, by the time you land you’re 10 tons lighter. You have to put less power in to keep the aircraft in the air because you’re fighting less gravity — that makes a real difference.”

In the court of public opinion, the key milestone for hydrogen will be widely publicized test flights of larger aircraft. General aviation and rotorcraft may make for better testing platforms and more feasible initial entrants into the market, but the average airline consumer is unlikely to ever step foot in them.

“What some of the start-ups are doing with smaller aircraft today doing is creating the proof case that this can work, but I think the public will get excited about something more on the scale of 100 passengers,” said Riedel.

Riedel is also closely monitoring efforts by regulators to push for further development of green hydrogen infrastructure, including goals of lowering the cost of clean hydrogen to incentivize its industrial use.

“Getting to numbers like $2/kg will be a big milestone,” he said. “If we can show that’s possible — and I’m hopeful that other industries like trucking are helping to pave the way — that will be a big milestone for hydrogen’s use in aviation.”

In the long run, the most likely bet is that a wide portfolio of solutions encompassing hydrogen, SAF, batteries, and a slew of novel propulsion proposals will all play a role in helping aviation reduce its carbon footprint — a task that demands an ‘all hands on deck’ approach if the industry is to meet its emission reduction goals.

“Decarbonizing aviation is critical to solving the climate crisis and will become increasingly critical in the coming decades,” said Ivanenko. “That’s why we must start now.”

BOEING PLOTS ITS OWN COURSE TO SUSTAINABILITY

Hydrogen will play a significant role in aviation’s future, says Brian Yutko, vice president and chief engineer of Sustainability and Future Mobility for Boeing, but right now the company believes it is most valuable as a tool for scaling up production of Sustainable Aviation Fuels (SAF).

Noting that hydrogen is required to produce sustainable aviation fuels, and not just power-to-liquid SAF, Yutko said Boeing is “fully supportive of the green hydrogen economy” as part of its global efforts to bolster the SAF supply chain.

“SAF is in regular use today and offers the most immediate and largest potential to reduce carbon emissions over the next 20 to 30 years in all aviation segments,” said Yutko. “Given the near-term needs for emission reductions, and that the primary sources of aviation emissions are longer haul flights, our near-term emphasis will remain on SAF even as we invest in further exploring hydrogen and electric propulsion alternatives.”

Boeing has been researching both hydrogen combustion and hydrogen fuel cell application onboard aircraft for over 15 years, including five flight demonstrations with crewed and uncrewed aircraft.

From these tests, the company has determined that practical issues with using hydrogen on an aircraft from an engineering standpoint are twofold: 1) maintaining a high gravimetric energy density while practically installed on the aircraft as either a very high-pressure gas or more likely as a cryogenically-cooled liquid; and (2) dramatically increasing the size of the storage tanks and integrating onboard an even larger aircraft, since hydrogen is 4x less dense by volume than Jet A or SAF.

Yutko also noted that changes to systems beyond the aircraft — infrastructure and energy pathways — are required to enable hydrogen’s use and its actual environmental benefits. As an example, due to the total lifecycle effects of producing, transporting, and using green hydrogen — the use of which is “a necessity for any future hydrogen aircraft to reduce emissions” — Boeing’s analysis indicates that hydrogen’s near-term use an energy carrier on an aircraft would actually increase net emissions to the environment, given how it is currently produced from non-renewable sources. “The production of green hydrogen is required to achieve a lifecycle benefit,” he said.

The company’s sustainability strategy focuses on four key pillars:

• Airline fleet replacement, in which each generation of new airplanes reduces fuel and emissions by 15-25%.

• Network operational efficiency, which can reduce emissions by about 10% through procedures such as continuous descent approaches, equipment upgrades, and data-driven fuel efficiency software.

• Renewable energy transition, which primarily revolves around SAF but long-term may include green hydrogen or batteries.

• Advanced technology, reflected in the newest generation of digital design, test and production tools; airframe, propulsion, and systems technology; and specialized power solutions for different market segments and aircraft sizes.

“We believe this strategy allows our industry to decarbonize aerospace while ensuring the connectivity, societal and economic benefits that come from air travel are available to people everywhere,” said Yutko.